Hello friends welcome to the best swing trading course article in this article we will discuss the topic best swing trading course and swing trading stocks for next week and also chart ink screener for swing trading. I will tell you the best swing trade stock screener how you can do and swing trader scanner.

In stock market there are three types of trading intraday trading swing trading and long term trading. So here we will discuss the swing trading course in details. In swing trading there are number of trading strategies to invest but I am telling you here simple and best swing trading strategies in this article. This swing trading strategy is very effective and also returns are also good and you can easily find the stock also by using this strategies. So first I will discuss the swing train strategy and then I will tell you the rules and how you can find the stock and after find stocks then how you can enter in the stock and how you can put stop loss and then when you can book the profit also how you can define the target of the swing trade means where you can exit the trade.

Swing Trading Strategy-Swing trading course

In this trading strategy first you can find the stock which it’s previous high not break long time means the stock which not cross it’s previous high greater than 4 to 5 years. It means that any stock you can find it made high previous time and his high not break until after that minimum 4 to 5 years. It means that this stocks until now trading in the range. And after 4 to 5 years this stock trying to break previous high and that time on monthly or weekly chart time frame you can try to enter in this talk on daily and weekly time frame. So I give you some example so after that your doubt will clear.

1.Swing Trade Stocks -Swing Trading Course

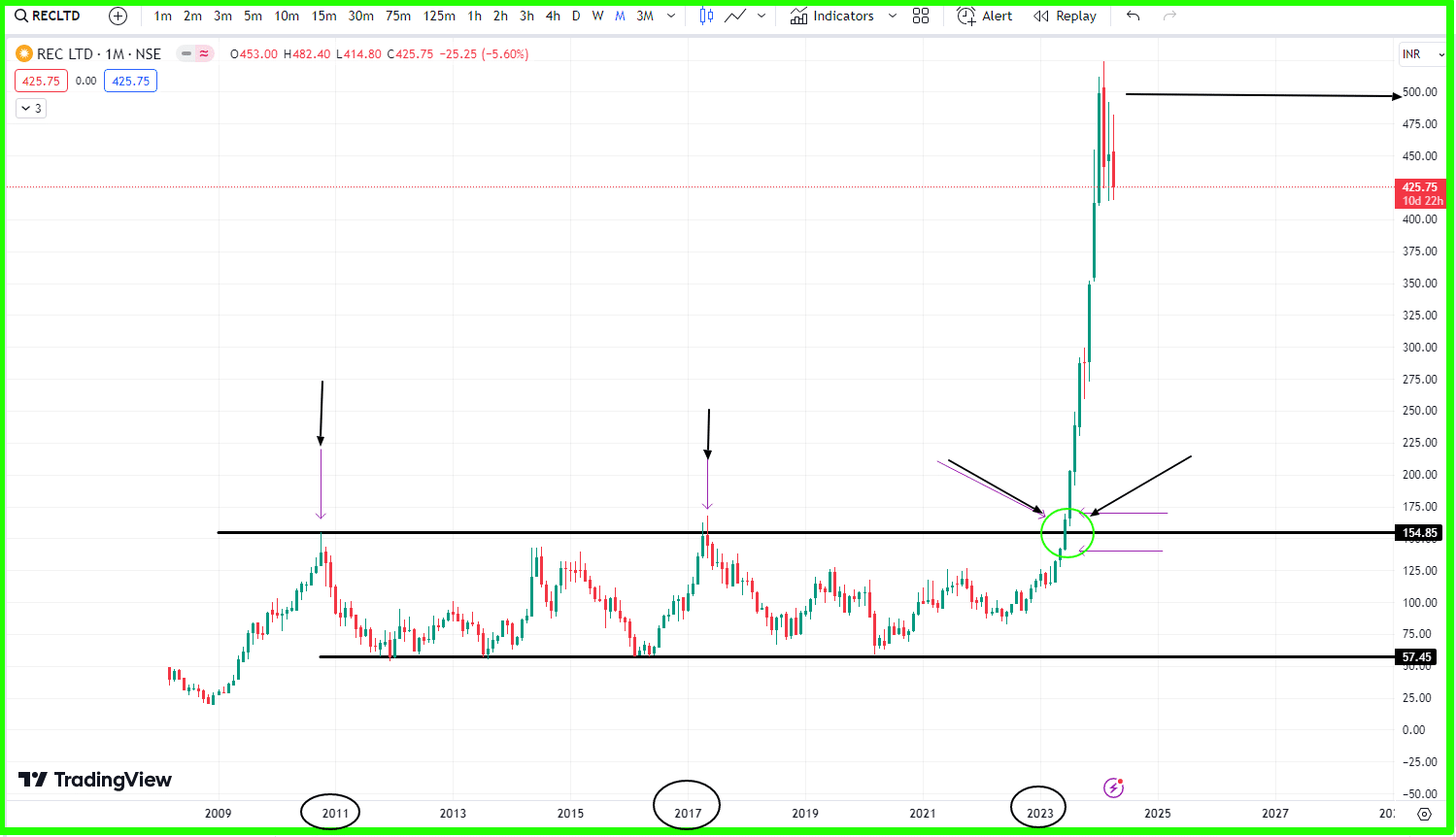

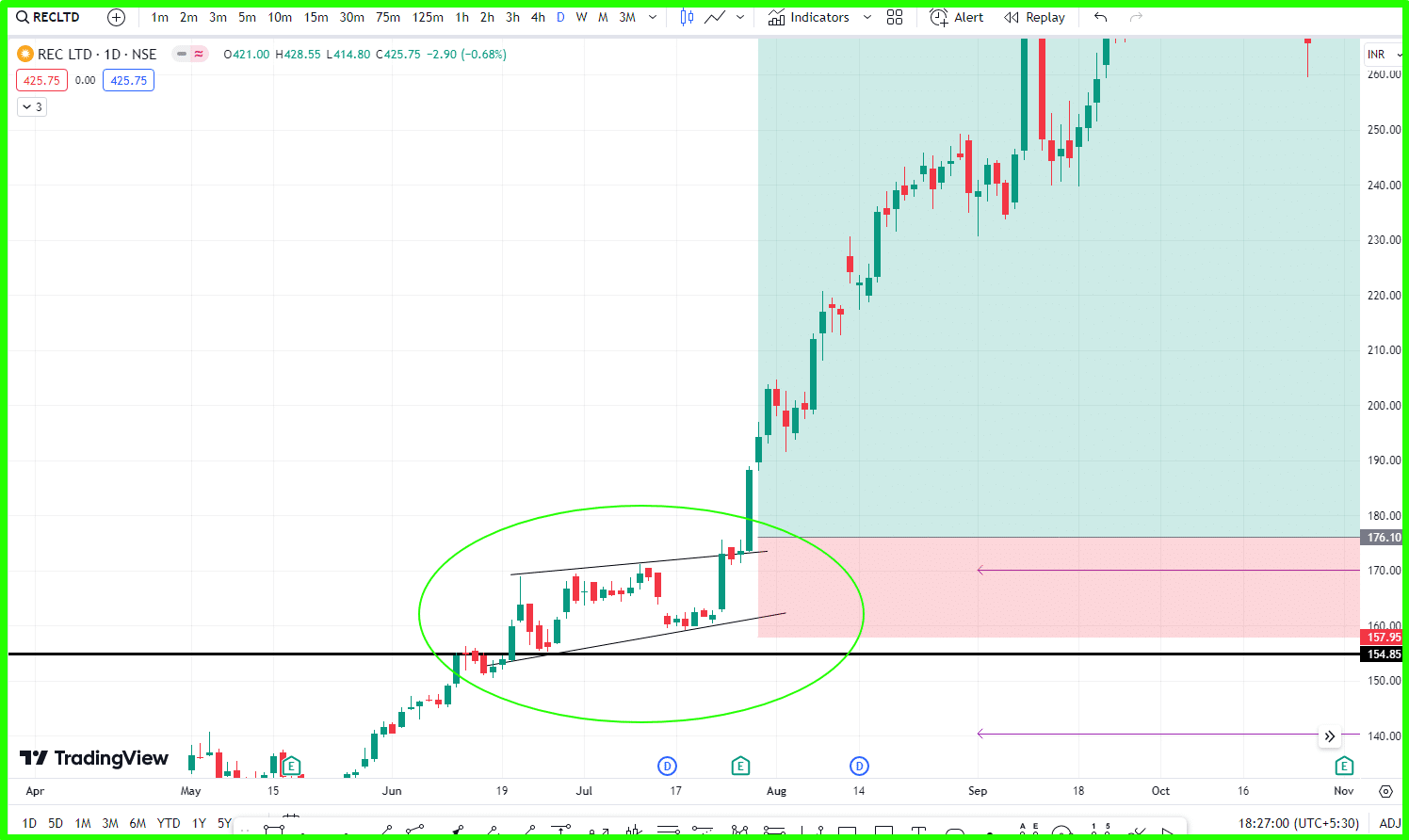

So the above chart is RAC Limited stocks monthly chart. So in this talk you can see that in clearly and talk in 2011 made high also I mention with arrow nearby 154 rupees price after that in 2017 stock again comes near by 154 rupees but not cross and comes again down. But in a nearby after 2023 you can see that stock break out with best candle and this candle is monthly candle also I mentioned with green circle and arrow and you can see that after this break out is happen how much stocks gives a return means at break out level stocks price is nearby 154 and after that stock made high near by 500 rupees means thing that how much times stocks gives return. But only stock use break out so we can’t enter in the stock first on monthly break out after that we will shift on daily time frame or weekly time frame and then we will find that location any bullish pattern to enter in this talk so our stop loss will be minimum and also technically good and so that risky is low and return will get huge.

Read Also This

–Tata Motors Share Price Target

–Adani Power Share Price Target

-Adani Total Gas Share Price Target

-Reliance Power Share Price Target 2030

So here you can see that daily time from chart of rec Limited and we discussed a monthly chart in in first image so in monthly chart I mentioned a circle green colour and these green colour circle if we seen in daily time frame then green circle will look like this so you can see in the chart.. In green circle you can see that there is create a bullish pattern and after break out this pattern and we make stop loss small below the pattern and after that you can see that how much time se return we get here. So like this entry you need to find the stock which consoliding or stock which not break it’s all time high long time means at least minimum 4 to 5 years and greater than this. So below I mention some more chart which gives us return like this after it break out long time high.

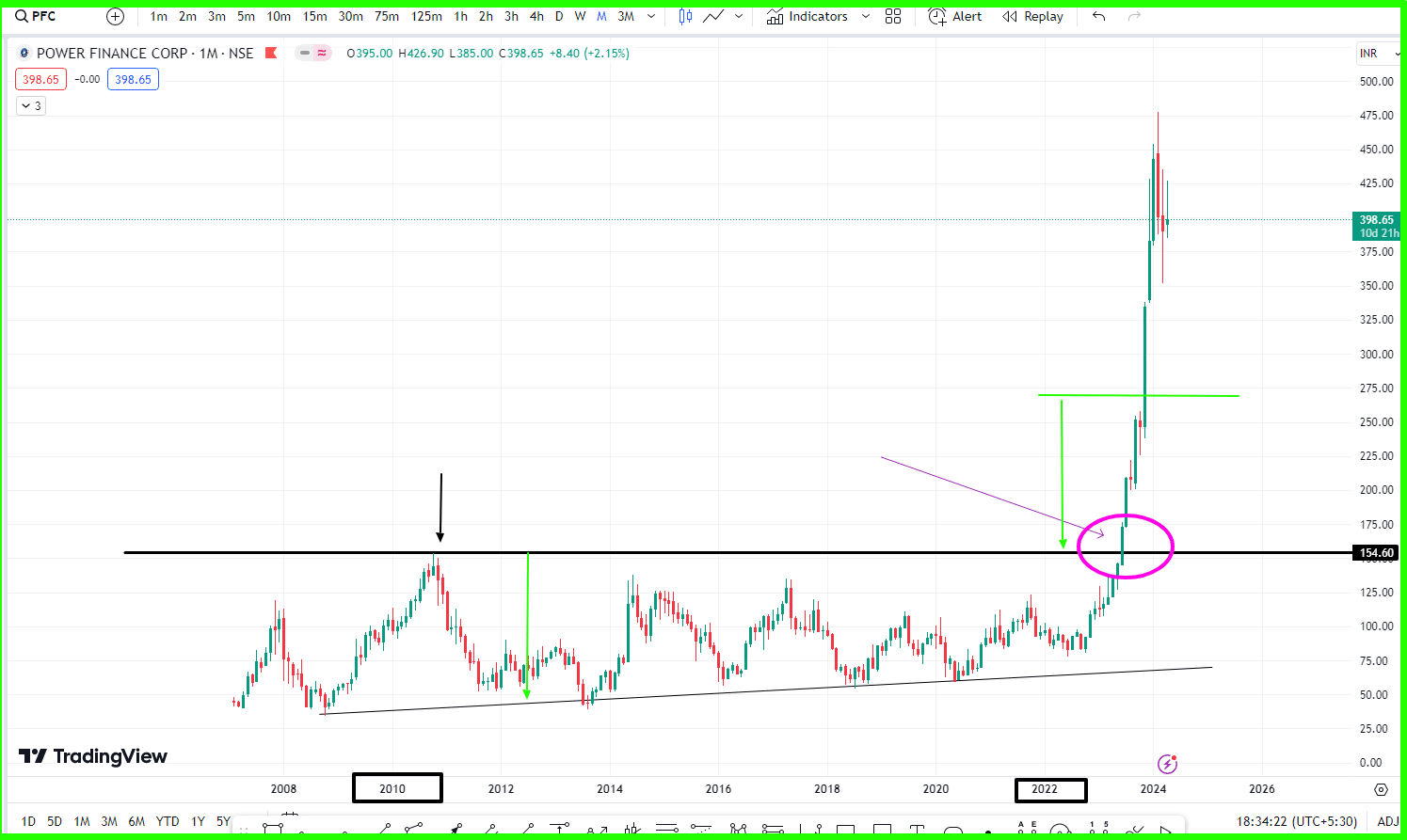

2.Power Finance Corp ltd PFC-swing Trade stock

So in the above image you can say that power Finance Corporation chart and in the chart stocks all time high 2010 nearby and his these high break in 2023 near by and after that you can see that stock those very high return. So that you need to find like this stocks which is at a break out level and his break out level is very long term in years and after that you will get very good return but understand this they are must be your stop loss because in the stock market nothing is 100%.

Read Also This

–Tata Motors Share Price Target

–Adani Power Share Price Target

-Adani Total Gas Share Price Target

-Reliance Power Share Price Target 2030

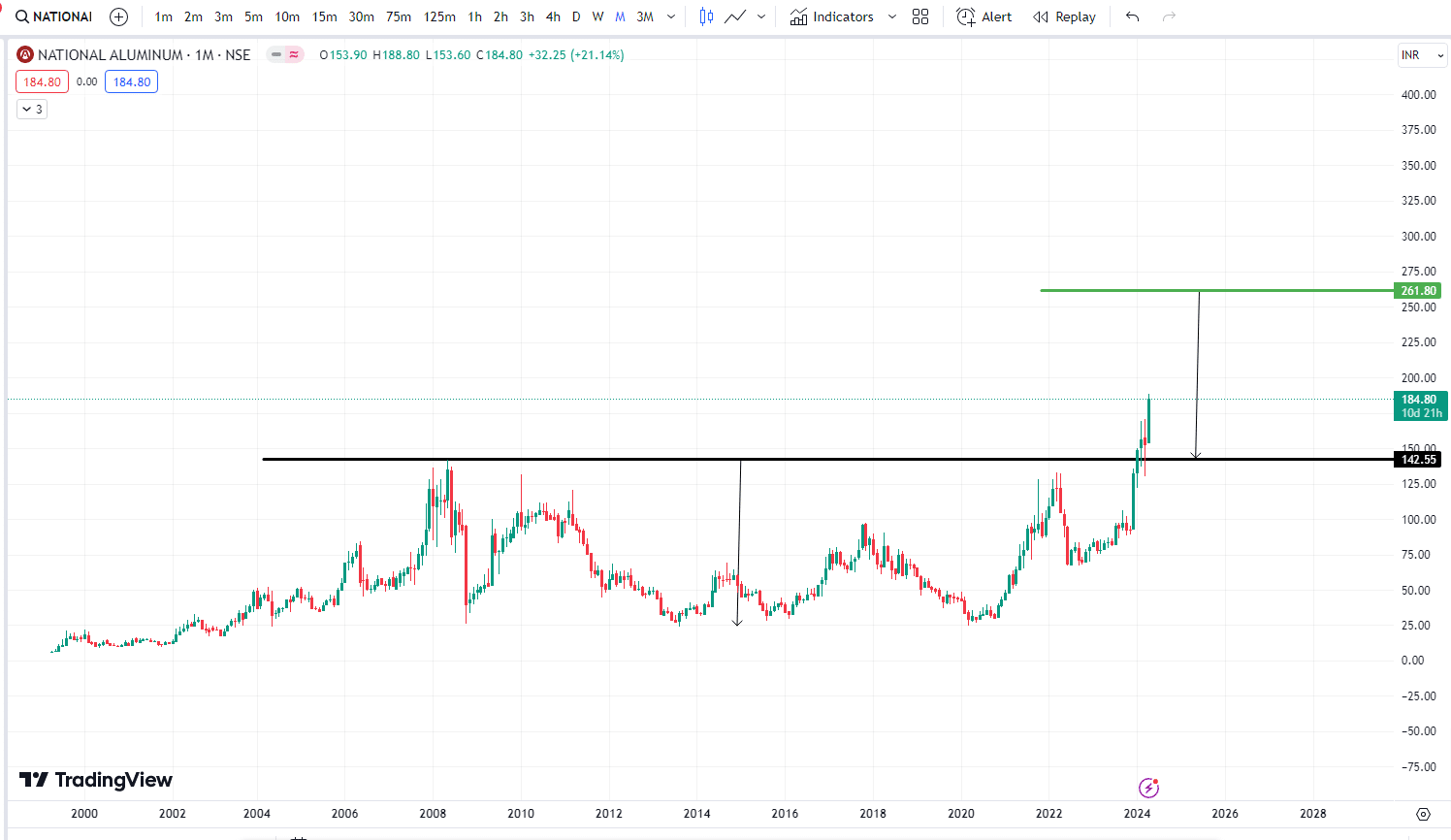

3.NATIONALUM -Swing Trade stocks for this week-Swing Trading Course

Conclusions Swing Trading Course

Friends if you like this strategy of Swing trade then you can please give the rating for this article and also share to your friend and relatives because this strategy is very good and also it gives very good return and I will try in future to post here the chart in which the opportunity will get but before that you show your response to this article swing trading course.

FAQ Swing Trading Course

Which course is best for swing trading?